€93,124.65

1.57%/year

(€5,390.64)

- Price return

-

-1.34%/year-€4,637.15

- Income return

-

3%/year€10,370.80

- Cost ratio

-

-0.1%/year-€343.01

No benchmark

Holdings

|

Security

|

Position

Holding period

|

Cumulative cashflow

per share

|

Value

per share

|

Price return

in %

|

Income return

in %

|

Costs amount

in %

|

Net profit/loss

in %

|

Allocation %

|

|---|---|---|---|---|---|---|---|---|

|

205

1315 days

|

€4,889.25

€23.85/share

|

€13,162.83

€64.21/share

|

€8,273.58

31.64%/year

|

€992.57

4.53%/year

|

-€17.61

-0.14%/year

|

€9,248.53

36.04%/year

|

14.13% | |

|

95

1315 days

|

€4,947.60

€52.08/share

|

€7,012.72

€73.82/share

|

€2,065.12

10.17%/year

|

€278.28

1.44%/year

|

-€17.81

-0.11%/year

|

€2,325.58

11.49%/year

|

7.53% | |

|

7

1287 days

|

€4,386.48

€626.64/share

|

€6,710.93

€958.70/share

|

€2,324.45

12.82%/year

|

€426.89

2.55%/year

|

-€15.85

-0.12%/year

|

€2,735.49

15.25%/year

|

7.21% | |

|

93

1350 days

|

€4,873.18

€52.40/share

|

€6,416.67

€69.00/share

|

€1,543.49

7.72%/year

|

€328.08

1.7%/year

|

-€17.62

-0.11%/year

|

€1,853.94

9.32%/year

|

6.89% | |

|

24

1350 days

|

€4,861.29

€202.55/share

|

€6,200.92

€258.37/share

|

€1,339.63

6.8%/year

|

€400.75

2.12%/year

|

-€17.58

-0.11%/year

|

€1,722.80

8.81%/year

|

6.66% | |

|

25

1367 days

|

€4,933.88

€197.36/share

|

€5,896.70

€235.87/share

|

€962.81

4.93%/year

|

€748.36

3.96%/year

|

-€17.83

-0.11%/year

|

€1,693.34

8.78%/year

|

6.33% | |

|

135

1350 days

|

€4,860.24

€36.00/share

|

€5,275.35

€39.08/share

|

€415.11

2.24%/year

|

€418.68

2.3%/year

|

-€17.58

-0.11%/year

|

€816.21

4.44%/year

|

5.66% | |

|

35

1315 days

|

€4,924.15

€140.69/share

|

€4,715.35

€134.72/share

|

-€208.80

-1.2%/year

|

€577.52

3.35%/year

|

-€17.73

-0.11%/year

|

€351.00

2.06%/year

|

5.06% | |

|

125

1287 days

|

€4,847.50

€38.78/share

|

€4,691.50

€37.53/share

|

-€156.00

-0.92%/year

|

€291.99

1.73%/year

|

-€17.46

-0.11%/year

|

€118.53

0.71%/year

|

5.04% | |

|

155

1287 days

|

€4,870.10

€31.42/share

|

€4,597.88

€29.66/share

|

-€272.22

-1.62%/year

|

€743.07

4.47%/year

|

-€17.54

-0.11%/year

|

€453.32

2.75%/year

|

4.94% | |

|

47

1287 days

|

€4,979.65

€105.95/share

|

€4,440.89

€94.49/share

|

-€538.76

-3.2%/year

|

€395.44

2.33%/year

|

-€17.93

-0.1%/year

|

-€161.25

-0.96%/year

|

4.77% | |

|

107

1350 days

|

€4,900.04

€45.79/share

|

€4,015.01

€37.52/share

|

-€885.03

-5.24%/year

|

€984.84

5.83%/year

|

-€17.72

-0.11%/year

|

€82.09

0.5%/year

|

4.31% | |

|

55

1350 days

|

€4,940.55

€89.83/share

|

€3,561.06

€64.75/share

|

-€1,379.49

-8.47%/year

|

€657.19

3.96%/year

|

-€17.86

-0.1%/year

|

-€740.16

-4.6%/year

|

3.82% | |

|

90

1349 days

|

€4,947.24

€54.97/share

|

€3,548.39

€39.43/share

|

-€1,398.86

-8.6%/year

|

€727.23

4.39%/year

|

-€17.77

-0.1%/year

|

-€689.39

-4.3%/year

|

3.81% | |

|

110

1350 days

|

€4,892.12

€44.47/share

|

€3,103.43

€28.21/share

|

-€1,788.69

-11.58%/year

|

€446.37

2.79%/year

|

-€17.19

-0.09%/year

|

-€1,359.50

-8.87%/year

|

3.33% | |

|

51

1350 days

|

€4,933.82

€96.74/share

|

€2,494.73

€48.92/share

|

-€2,439.09

-16.84%/year

|

€433.35

2.84%/year

|

-€17.83

-0.09%/year

|

-€2,023.57

-14.08%/year

|

2.68% | |

|

35

1286 days

|

€4,964.75

€141.85/share

|

€2,316.91

€66.20/share

|

-€2,647.84

-19.45%/year

|

€341.37

2.37%/year

|

-€17.87

-0.09%/year

|

-€2,324.35

-17.16%/year

|

2.49% | |

|

36

1350 days

|

€4,927.13

€136.86/share

|

€2,287.56

€63.54/share

|

-€2,639.57

-18.73%/year

|

€305.00

2.06%/year

|

-€17.81

-0.08%/year

|

-€2,352.39

-16.75%/year

|

2.46% | |

|

114

1189 days

|

€4,967.32

€43.57/share

|

€1,445.67

€12.68/share

|

-€3,521.65

-31.54%/year

|

€272.70

1.85%/year

|

-€8.72

-0.04%/year

|

-€3,257.67

-29.73%/year

|

1.55% | |

|

150

1315 days

|

€4,915.50

€32.77/share

|

€1,230.16

€8.20/share

|

-€3,685.34

-31.92%/year

|

€601.13

4.13%/year

|

-€17.70

-0.08%/year

|

-€3,101.91

-27.86%/year

|

1.32% |

Cash balances not available

Cash balances are not available because of the following reasons:

- Deposits/withdrawals weren't exported from your DEGIRO account. To fix the issue, please make sure to export all transactions from your account.

- There are no recorded deposits for trades entered manually or imported from a custom CSV file. To fix that, please manually enter all your deposits for those trades.

-

Some of your transactions were imported from

Transactions.csvDEGIRO exports which do not include cash transactions such as deposits. To fix the issue, reimport all your transactions fromAccount.csvexports

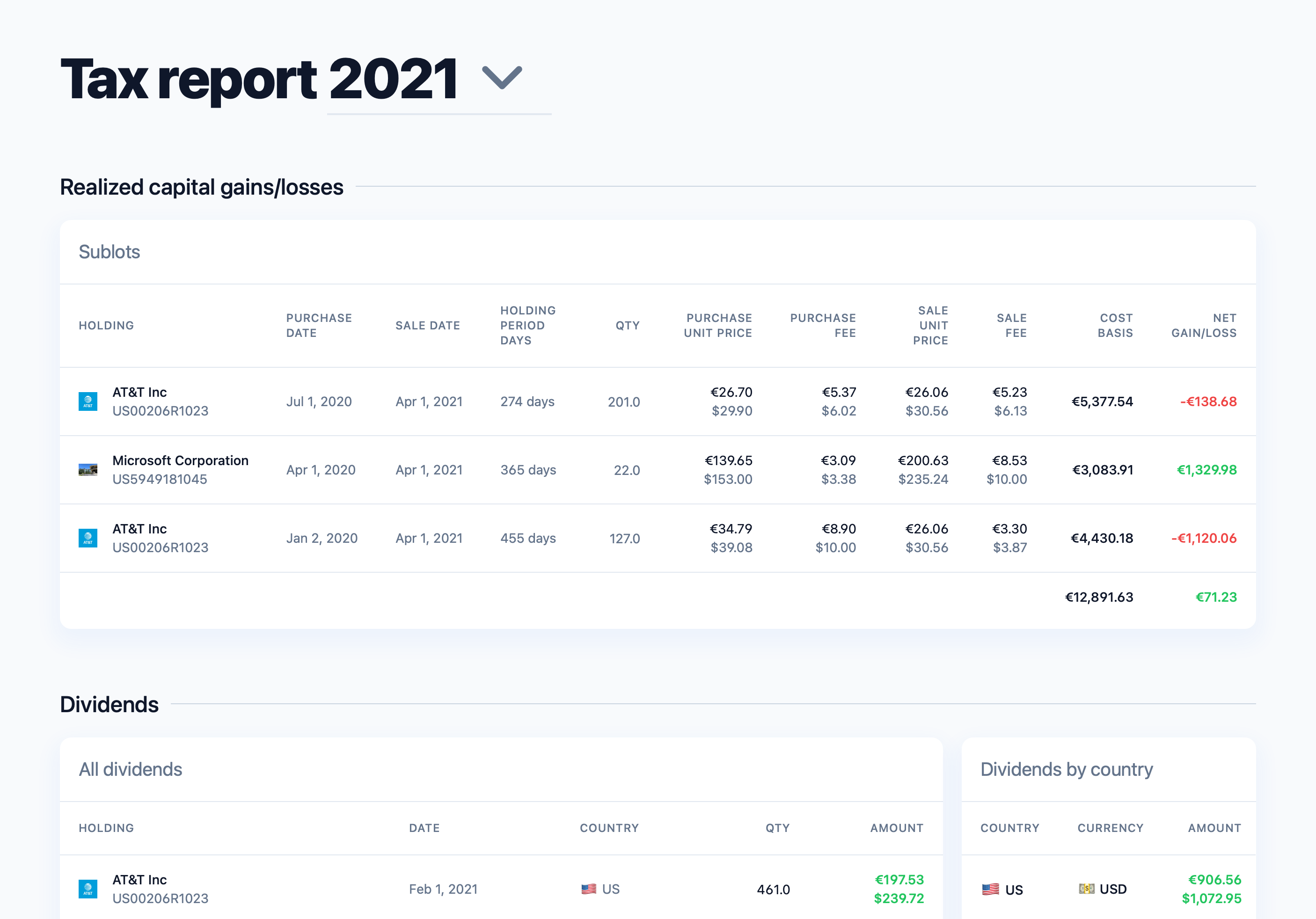

Dividends

Portfolio analysis

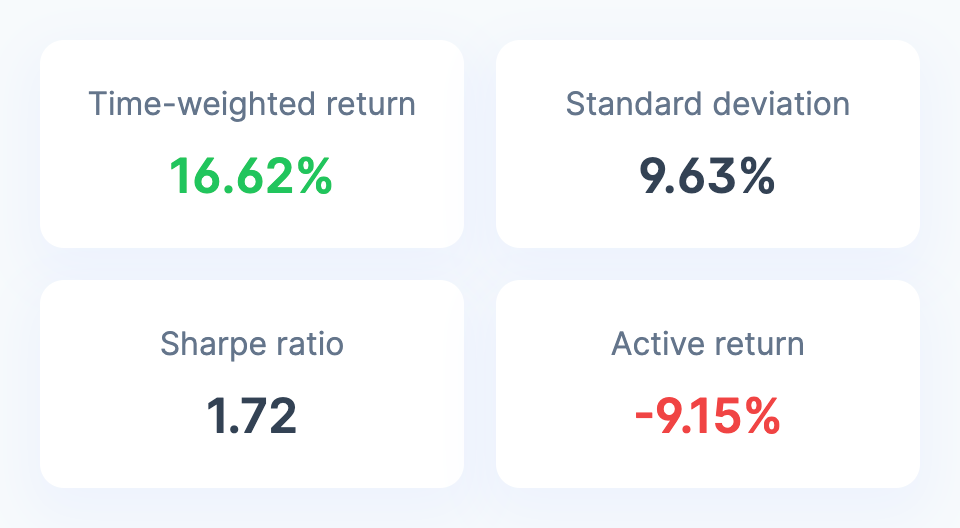

Is your return high enough given the risk you are taking? See your risk, risk-adjusted return and compare the return with a benchmark.

Example

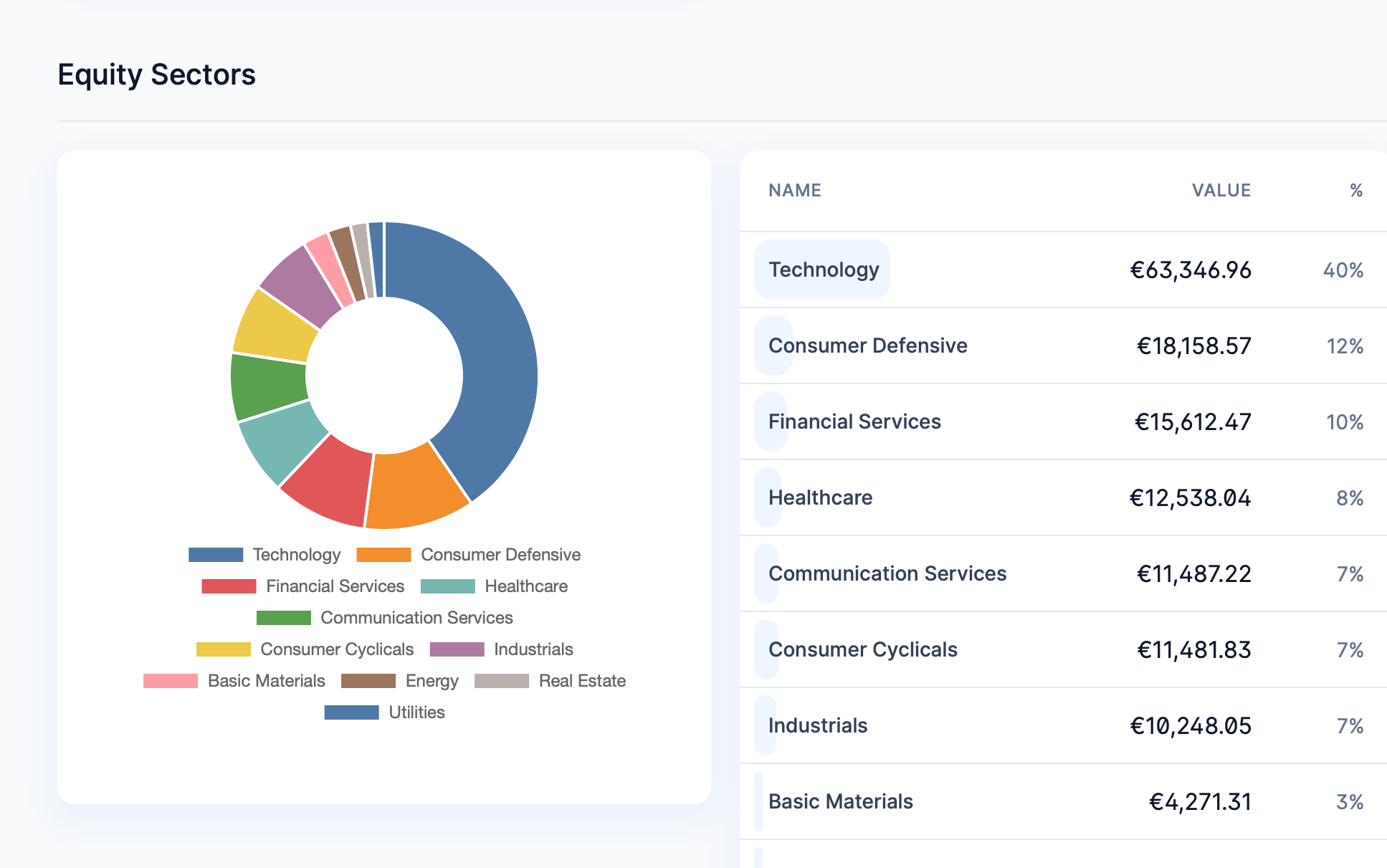

Portfolio breakdown

How well is your portfolio diversified? See a breakdown by a asset class, region, and sector.

Example

Example

| Date | Type | Description | Quantity | Amount | |

|---|---|---|---|---|---|

|

Sep 12, 2025

12:00 AM

|

Dividend |

€21.80

$25.55

|

|||

|

Sep 12, 2025

12:00 AM

|

Dividend |

€28.48

$33.37

|

|||

|

Sep 12, 2025

12:00 AM

|

Dividend |

€10.16

$11.90

|

|||

|

Sep 12, 2025

12:00 AM

|

Dividend |

€40.62

$47.60

|

|||

|

Aug 27, 2025

12:00 AM

|

Dividend |

€24.07

$27.90

|

|||

|

Aug 15, 2025

12:00 AM

|

Dividend |

€80.68

$94.30

|

|||

|

Aug 4, 2025

12:00 AM

|

Dividend |

€30.93

$35.78

|

|||

|

Aug 1, 2025

12:00 AM

|

Dividend |

€63.61

$72.55

|

|||

|

Aug 1, 2025

12:00 AM

|

Dividend |

€48.93

$55.80

|

|||

|

Jul 23, 2025

12:00 AM

|

Dividend |

€30.96

$36.30

|