A complete guide to passive investing in the EU (2021)

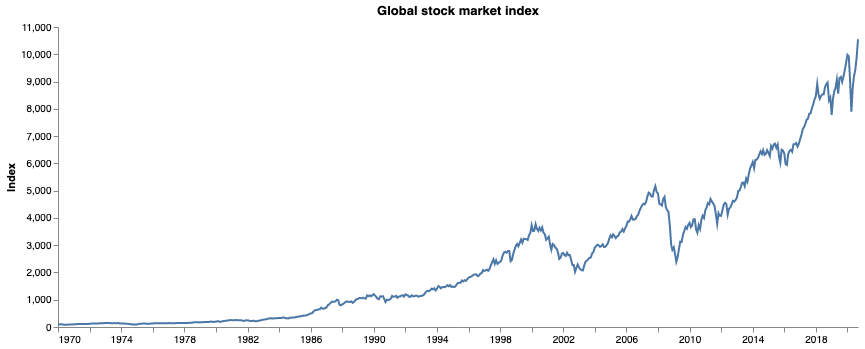

In this guide, I will show you step-by-step how to start with investing if you are an EU citizen. I will show you how to start by passively investing in the global stock and bond market using ETFs. Passive investing is a great way to start because it offers great results (in the past 50 years global stock market grew around 11% annually) with minimum effort and time. It only takes few minutes each month to make the trades.

I will walk you through every decision you need to make. I will give you practical recommendations on how to start now but hopefully I will give you enough information and context so that you can decide yourself what to invest in and how to build your portfolio. Finally, at the end of the guide, I will show you step-by-step how to make your first trades.

Why should I invest in the first place?

In short: compounding. As you can see in the image below, thanks to compounding, even a seemingly small difference in annual return rate has a huge impact on the amount of money you will have in retirement given enough time.

From the image above you can clearly see the opportunity cost of not investing.

Why stocks and bonds?

There are many types of investments (also called asset classes), such as stocks, bonds, real estate, or commodities, to name a few, that you can invest in. However, in this guide, we will focus only on two of those for the reasons explained in this section.

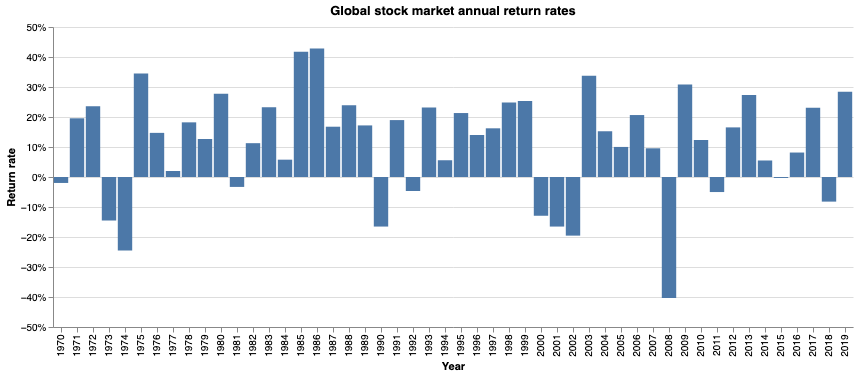

Investing in stocks has been historically one of the best ways to grow your money. In the past 50 years, the global stock market grew around 11% annually. However, with the high expected return comes relatively high risk, which means that the price is going up and down quite a lot. In some of the worst years, you might have lost up to 40% of your portfolio value.

That's why it is common to offset some of the risk by bonds, which are usually safe loans to governments and companies. On the other hand, they have a much lower expected return. (In the later section I will show you another way to reduce the risk of investing in stocks.)

So you need to find a balance between high return / high-risk investments, such as stocks, and some other low risk / low return alternative.

What stock/bond ratio should I choose?

Before you decide how much money to put into stocks and bonds, you need to make sure you know what your investment goal and horizon is. For example, if you are young and want to grow your savings as much as possible, you might invest in a more aggressive portfolio with 100-90% of stocks. On the other hand, if you are saving up money to buy a house in few years and just want to preserve the value of your money, you want to stick to something way more conservative.

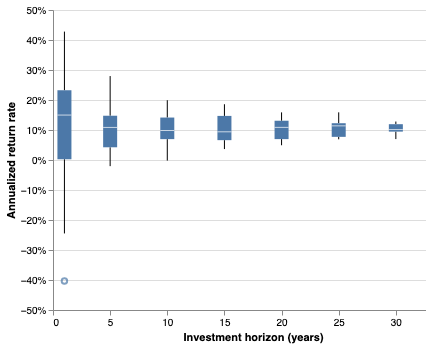

To illustrate the importance of the investment horizon, let's take a look at historical annualized returns for different time periods.

From the image above, we can see that if you invest only for one year, your returns might vary wildly. In the past, annual global stock returns varied from +40% to -40%. However, if you stay invested for, let's say, 20 years, you can expect your annualized returns to be somewhere between 7% and 13%.

You should also think about your risk tolerance. If you know that you will totally freak out if your portfolio goes down by 10% in some of the years, you should also probably choose something more conservative to stay sane.

Below, you can see a table with expected returns, standard deviations, and values at risk for different stock/bond ratios. Both standard deviation and value at risk are risk measures. Standard deviation tells you how much the actual returns deviate from the expected return. Value at risk (VaR) tells you how much you can expect to lose in any given year with certain confidence (in our case we use 95% confidence). So, if the VaR is 5% you can be 95% confident that you won't lose more than 5% of your portfolio value at any given year.

| Stocks % | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | 100% |

|---|---|---|---|---|---|---|---|---|---|

| Expected return | 8.90% | 9.28% | 9.67% | 10.06% | 10.44% | 10.83% | 11.22% | 11.61% | 11.99% |

| Standard deviation | 6.65% | 7.05% | 7.89% | 9.06% | 10.45% | 11.98% | 13.60% | 15.29% | 17.02% |

| Value at risk | 2.05% | 2.31% | 3.31% | 4.85% | 6.74% | 8.87% | 11.15% | 13.54% | 16.01% |

(We are not showing asset allocations with less than 20% of stocks because they are not efficient, which means that you can get a better expected return with lower risk more stocks.)

If you are still not sure what ratio to choose, there are some rules of thumb you can follow.

For example, Warren Buffet recommends putting 90% of your money in stocks and 10% in bonds 1. Jack Bogle, who is the father of index funds, recommended putting 100 (or 110) minus your age % of your money to bonds and the rest to stocks. So if you are 20, you would invest 20% into bonds and 80% in stocks.

The ratio of asset classes, such as 80/20, is called asset allocation.

Finally, it is important to note that there is no guarantee that the markets will behave the same way they did in the past. On the other hand, the only assumption we make here is that the global economy as a whole will keep growing at a similar pace.

How do I choose which stocks and bonds to invest in?

You don't. Instead, invest in whole markets, such as the global stock market, through index funds. An index fund invests in stocks according to an index, such as MSCI World Index that tracks around 1500 companies in 23 developed countries. By investing in a fund that tracks this index, you will own a small piece of all 1500 companies proportionally to their market capitalization. So for example, as of Feb 1, 2021, you would invest 4.4% in AAPL, 3.3% in MSFT, 2.75% in AMZN, and so on.

This is great for several reasons:

-

Your portfolio is highly diversified. Diversification is a way of reducing the risk by doing a lot of smaller bets. So even if a few of the companies go bust, you don't care that much. On the other hand, you will benefit from some skyrocketing companies that you wouldn't otherwise invest in.

-

You make way fewer trades than you would if you bought individual stocks and thanks to that you will save on fees and taxes.

-

You don't have to make any decisions and spend time studying companies so you are free to do what you actually enjoy.

This strategy is called passive investing because you just choose your asset allocation in the beginning and then just simply stick to it and only buy more of the same each month or quarter.

People often ask me why passive investing when you could have a higher return with active investing/trading. It's true that you could theoretically get higher returns if you bet on the right stock. But unless you have a crystal ball you are very unlikely to do that consistently for many years and you would spend a lot of time doing that and in the end wound up having way lower returns than if you simply accepted the market return.

It is important to realize that the stock market is not a zero-sum game. You don't have to beat it to benefit from it. As I said earlier, the market grew around 11% annually for the past 50 years. So by doing literally nothing you can get 11% p.a. You are very unlikely to have 11% gains for 20 years by picking individual stocks.

How can I invest in the index funds?

The easiest and the cheapest way to invest in index funds through so-called exchange traded funds (ETF). ETF is a fund whose shares are publicly traded the same way as normal shares of publicly traded companies. So the only thing you need to start is an investment (also called brokerage) account which you can open online in few minutes. I will show you how in a later section.

There are several reasons why ETFs are great:

- They are cheap. Because the fund just follows an index and there are no expensive fund managers who pick the stocks to buy, they are extremely cheap. Usually, they cost around 0.1% per year, compared to much higher fees of active mutual funds. They are also more tax-efficient than traditional mutual funds. Besides that, buying and selling them is often free or very cheap.

- They are liquid. You can buy and sell them whenever the stock exchange is open, which is typically every business day.

There are several factors to consider when choosing the ETFs:

- regulatory stuff,

- total expense ratio,

- use of income,

- currency hedging,

- trading currency.

I will briefly explain each one in the following sections.

Regulatory stuff

If you are an EU citizen, since Jan 1, 2018, you can buy only ETFs that are UCITS eligible. You can usually tell whether they are UCITS eligible by having "UCITS" in their name, e.g. iShares Core MSCI World UCITS ETF. Alternatively, you can find it in their fact sheets.

Total expense ratio

The total expense ratio (TER) is a measure of the total costs associated with managing and operating the product in percentages per year. So if the index that the ETF follows has 10% annual return and the TER is 0.1%, your actual return will be 9.9%.

Use of income

When choosing the ETFs it is important to consider whether you want to use them as a source of income right now or whether you want to accumulate wealth to save up for, let's say, retirement.

- If you want to generate regular income from dividends, you should choose distributing ETFs since they distribute their income in cash regularly (monthly/quarterly/annually) directly to your brokerage account. This way you don't have to sell any shares to get cash but on the other hand, you will have to pay income taxes.

- If you want to build wealth (e.g. for retirement) it is better to invest in accumulating ETFs since they automatically reinvest the income at no extra cost so you will save on trading fees and (in some countries) you don't have to pay taxes from the dividends since they were not distributed.

Currency hedging

Some ETFs are hedged (which is a fancy word for insured) against currency fluctuations. Let's say your home currency is EUR but most of the ETF's assets are in USD. If the ETF's assets go up by 10% but the value of USD (relative to EUR) goes down by 10%, you won't gain anything in the end. That's why some ETF's are insured against this risk, which is called currency risk, and will give you whatever the assets returns were regardless of the currency movements. However, if the value of the USD goes up, you won't benefit from it. Since the fluctuations usually cancel out in the long term (one day it goes up, the other one it goes down) and you have to pay a premium for the insurance (and hence the TER is higher), I don't recommend buying the hedged ones (and if your currency is not EUR chances are there is no ETF hedged against your currency anyway).

Trading currency

Finally, I want to mention that the trading currency of the ETF does not influence the performance of the ETF at all. However, if you buy ETFs traded in different currencies than your home currency you will have to most likely pay some exchange fees (depending on the brokerage).

Choosing the ETFs

When choosing an ETF to invest in, you first need to decide which market segment you want to invest in, then which index you want to follow and finally the ETF that follows that index. (I will save you the work and give you recommended ETFs in the next section.)

So, let's say we want to invest in the global stock market.

There are two widely used indices that track the global stock market: MSCI ACWI and FTSE All-World.

When we google "MSCI ACWI UCITS ETF" and "FTSE All-World UCITS ETF" we will find many ETFs. So let's put some of them in a table and compare them so we can choose the best one.

| Fund | TER | Use of income | Hedged |

|---|---|---|---|

| iShares MSCI ACWI UCITS ETF | 0.20% | Accumulating | - |

| Xtrackers MSCI AC World UCITS ETF 1C | 0.25% | Accumulating | - |

| SPDR® MSCI ACWI UCITS ETF | 0.40% | Accumulating | - |

| SPDR® MSCI ACWI EUR Hdg UCITS ETF | 0.45% | Accumulating | EUR |

| SPDR® MSCI ACWI USD Hdg UCITS ETF | 0.45% | Accumulating | USD |

| Vanguard FTSE All-World UCITS ETF | 0.22% | Accumulating | - |

| Vanguard FTSE All-World UCITS ETF | 0.22% | Distributing | - |

We can see that there are quite a few ETFs following that index. Unfortunately, they are all quite expensive. I would expect the TER to be somewhere around 0.1%.

Fortunately for us, indices are usually hierarchical, which means that we can build the portfolio from multiple cheaper ETFs that will cover the same assets.

For example, MSCI ACWI is divided into two sub-indices: MSCI World Index and MSCI Emerging Markets IMI Index.

MSCI World Index covers large and mid sized companies in developed markets and makes up around 90% of the MSCI ACWI index. MSCI Emerging IMI Markets Index covers large, mid, and small sized companies in emerging markets and covers around 10% of the total index.

Again, if you google for the available ETFs that follow those indices, you will find out that you can buy the following two ETFs with the total (weighted) TER 0.126% which is much cheaper than any of the ETFs above.

| Fund | TER | Use of income | Hedged |

|---|---|---|---|

| SPDR® MSCI World UCITS ETF | 0.12% | Accumulating | - |

| iShares Core MSCI EM IMI UCITS ETF | 0.18% | Accumulating | - |

Recommended ETFs

There are a lot of different indices and ETF providers so it might be a bit difficult to choose them. So below is a list of recommended ETFs that are cheap and liquid (you can always find someone who will buy it).

Accumulating portfolio

| Fund | ISIN | TER | Description |

|---|---|---|---|

| SPDR® MSCI World UCITS ETF | IE00BFY0GT14 | 0.12% | Large+mid cap stocks in developed markets |

| iShares Core MSCI EM IMI UCITS ETF | IE00BKM4GZ66 | 0.18% | Large+mid+small cap stocks in emerging markets |

| iShares Core Global Aggregate Bond UCITS ETF | IE00BDBRDM35 | 0.10% | Global bonds |

Distributing portfolio

| Fund | ISIN | TER | Description |

|---|---|---|---|

| Vanguard FTSE All-World UCITS ETF | IE00B3RBWM25 | 0.22% | Large- and mid-sized company stocks in developed and emerging markets |

| Vanguard Global Aggregate Bond UCITS ETF | IE00BG47KB92 | 0.10% | Global bonds |

Where do I buy the ETFs?

You can buy ETFs on a stock exchange. But you cannot buy every ETF on every exchange. The ETF has to be listed on the given exchange for you to be able to buy it there. Typically, each ETF is listed on multiple exchanges so you can choose where to buy it at.

There are several criteria to consider when choosing an exchange:

- Trading currency. Although trading currency does not impact your returns, you can minimize/eliminate conversion fees if the ETFs are traded in your home currency.

- Fees. Some brokerages charge different fees for different exchanges. For example, they offer no fees for local exchanges. In that case, prefer the local ones.

- Trading volume. The more trades of the given ETFs there are, the better. More volume offers better liquidity (the ability to sell) and lower bid-ask spread.

- Listed ETFs. Some brokerages charge a fee for each exchange you buy at. In that case, prefer an exchange that lists all (or at least most of) your ETFs to minimize the fee.

Below, there are all exchanges that list all the ETFs from the recommended portfolios.

Accumulating portfolio ETF listings

Deutsche Börse (Xetra)

| Fund | Ticker | Trading currency |

|---|---|---|

| SPDR® MSCI World UCITS ETF | SPPW | EUR |

| iShares Core MSCI EM IMI UCITS ETF | IS3N | EUR |

| iShares Core Global Aggregate Bond UCITS ETF | EUNA | EUR |

Borsa Italiana

| Fund | Ticker | Trading currency |

|---|---|---|

| SPDR® MSCI World UCITS ETF | SWRD | EUR |

| iShares Core MSCI EM IMI UCITS ETF | EIMI | EUR |

| iShares Core Global Aggregate Bond UCITS ETF | AGGH | EUR |

SIX Swiss Exchange

| Fund | Ticker | Trading currency |

|---|---|---|

| SPDR® MSCI World UCITS ETF | SWRD | USD |

| iShares Core MSCI EM IMI UCITS ETF | EIMI | USD |

| iShares Core Global Aggregate Bond UCITS ETF | AGGH | EUR |

Distributing portfolio ETF listings

Deutsche Börse (Xetra)

| Fund | Ticker | Trading currency |

|---|---|---|

| Vanguard FTSE All-World UCITS ETF | VGWL | EUR |

| Vanguard Global Aggregate Bond UCITS ETF | VAGE | EUR |

How do I buy the ETFs?

To be able to buy an ETF on an exchange, you need a brokerage account. There are many brokers to choose from so let's take a look at the things to consider:

- Transaction fees. Usually, you have to pay a fee (commission) for each trade you make. However, the fees differ widely between the brokers. Some (discount) brokers even have no commission for some or all ETFs.

- Currency exchange fees. If you are going to buy/sell ETFs in a different currency than your home currency, make sure that the currency exchange fees are as low as possible.

- Other fees. Some brokers also have deposit/withdrawal or exchange connection fees so study the pricing page carefully to make sure you understand all the fees.

- Minimum deposit. Some brokers require quite a large minimum initial deposit, which might be limiting if you are just getting started and not comfortable investing a large sum of money yet.

- Available ETFs. Make sure the broker has access to all the ETFs you want to invest in. For example, some brokers have access only to US exchanges which typically do not list UCITS eligible ETFs.

- Trading platform / mobile app. You will use the platform to make trades each month so make sure it's easy to use.

- Safety. You should always check whether is the broker regulated and how is your account protected. Also, the bigger the broker is the more trustworthy it usually is.

Recommended brokerage account

I recommend (and use) DEGIRO because it has fairly low fees, is safe, and has an easy-to-use trading platform and mobile app. Below, there is a table with the fees:

| Description | Fee |

|---|---|

| ETF trades commissions | €2.00 + 0.038% |

| Commission-free ETF trades | Free |

| Exchange connection fee | €2.50 (max 0.25% of your account value) / calendar year / exchange |

| All foreign currency exchanges via Auto FX trader | 0.10% |

| Foreign currency exchanges from your home currency to your account currency | Free |

You can check the DEGIRO's review on BrokerChooser to see more details.

How do I start investing?

The first thing you need to do is to open a brokerage account and send some funds there. I recommend starting small in order to get familiar with the platform and with investing in general to gain some confidence in it.

Once the funds are available on your account, you can start buying your chosen ETFs.

As an example, let's say you want to invest €1000 in the accumulating portfolio and your asset allocation is 80/20. Based on your asset allocation and current market prices, you need to buy the following number of shares of each ETF:

| Fund | % of the portfolio | Price | Number of shares |

|---|---|---|---|

| SPDR® MSCI World UCITS ETF | 72% | 21.80 EUR | 33 |

| iShares Core MSCI EM IMI UCITS ETF | 8% | 30.36 EUR | 3 |

| iShares Core Global Aggregate Bond UCITS ETF | 20% | 5.34 EUR | 35 |

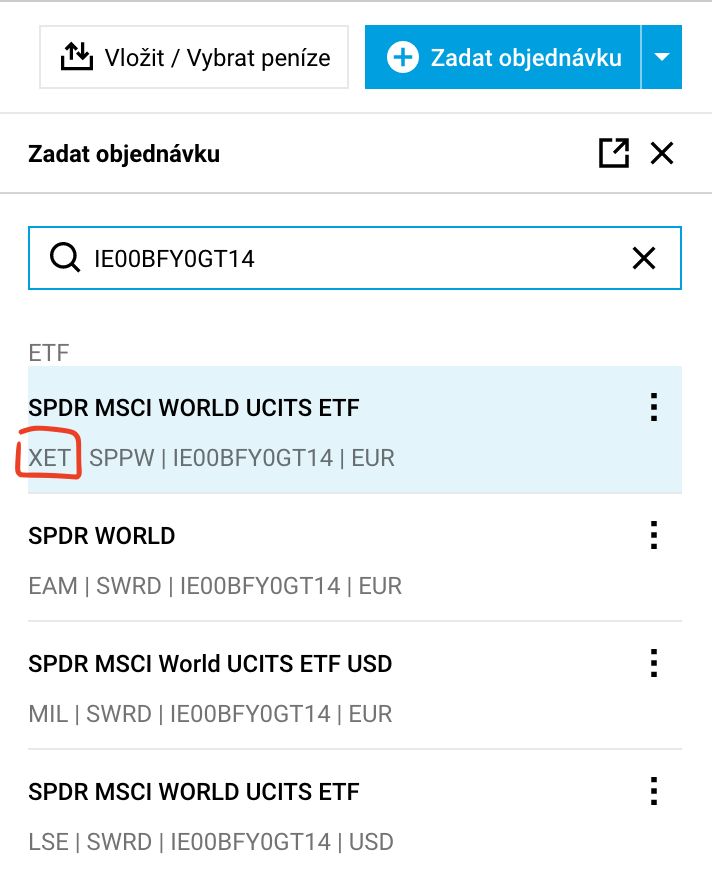

Now, go to the trading platform and buy each ETF:

-

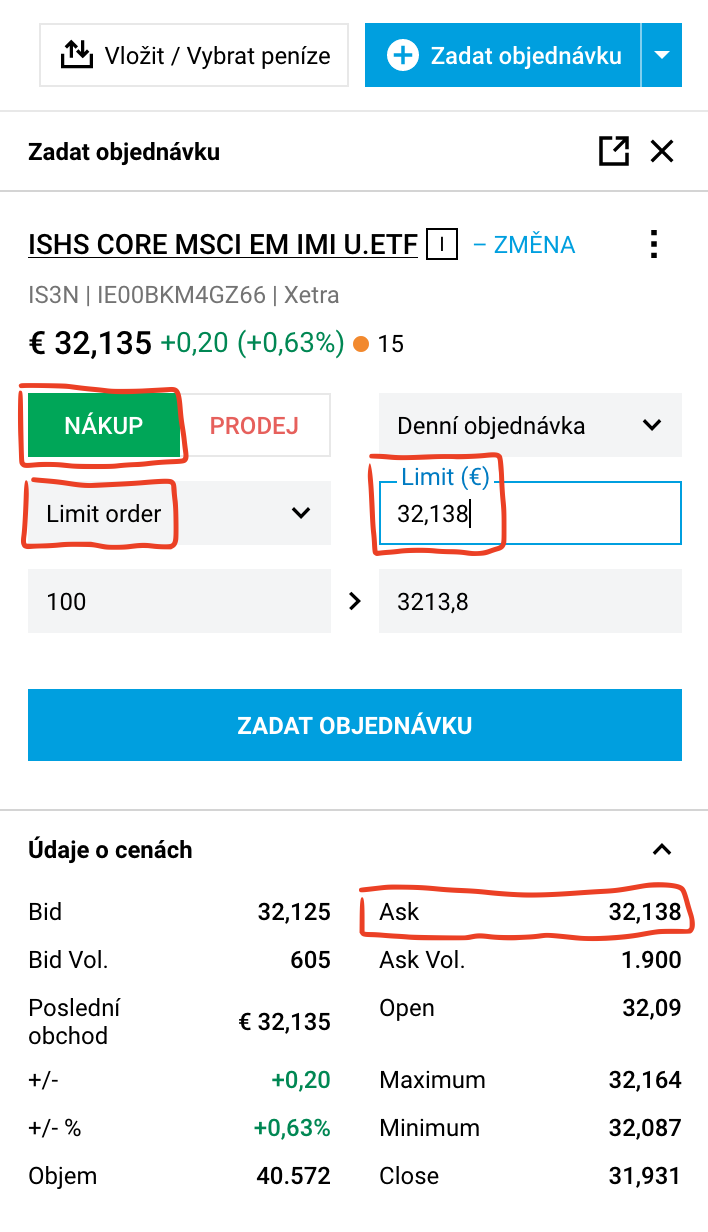

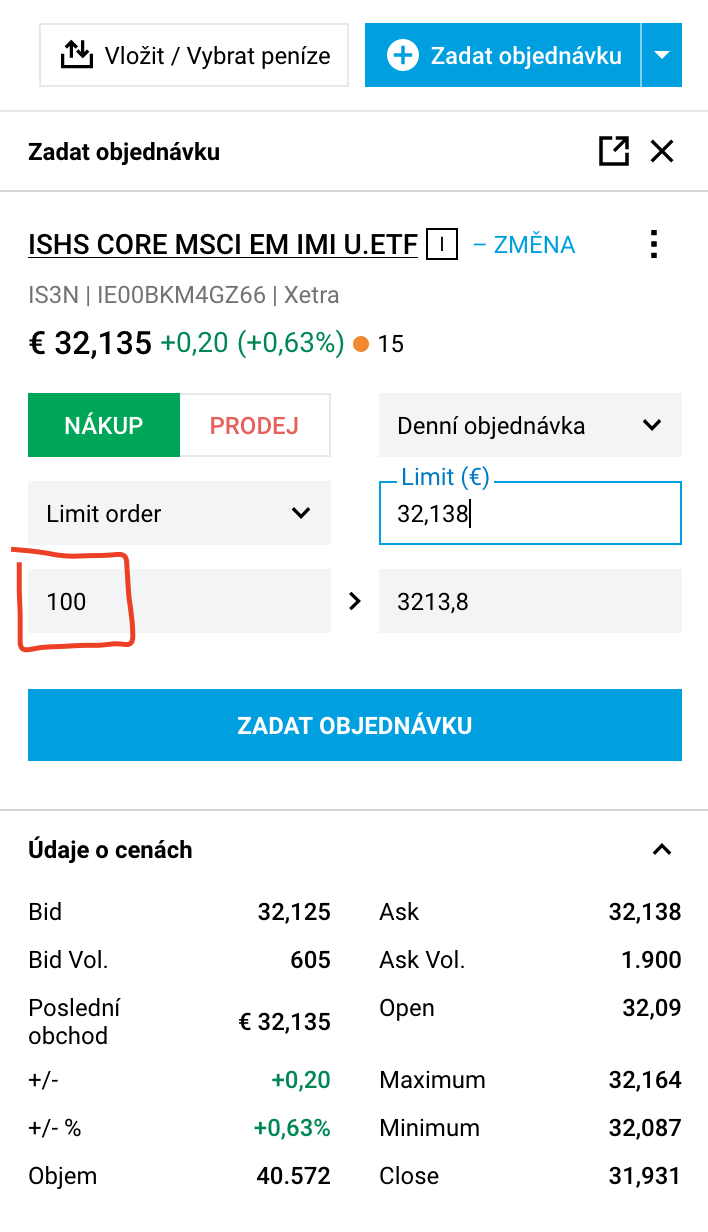

Click on "Place Order" in the top right corner and search the ETF you want to buy by its ISIN code. The ISIN code uniquely identifies a given ETF so you can be sure that you are buying the right one. You will see several results since the ETF is traded on multiple exchanges. So select the one traded on your preferred exchange.

-

Select "Buy" and "Limit order". By choosing the limit order you tell the broker to buy it only if they can buy it for a given price or lower. Otherwise, it will wait until there's someone willing to sell it for that price. I recommend using the limit order because you have the price under control. In the case of the market order, you basically tell them to "buy it at whatever price it's currently available for", which might not be the mid price you currently see. In order to set the price, take a look at the "Ask" price which is the lowest price for which someone is willing to sell the ETF at the moment.

-

Fill in the number of shares you want to buy.

-

Click on "Place Order" to make the order.

-

Repeat steps 1–4 for each ETF you want to buy.

And that's it! Now just keep going!

Hopefully, this guide answered all the questions you might have when starting to invest. If not, let me know.

If you found the post useful I would be super happy if you shared it with others!