Track and visualize your Trading 212 portfolio

Get a better view of your stocks, ETFs, and cryptocurrencies with an easy-to-use portfolio tracker.

Existing customer? Sign in

Get a better view of your stocks, ETFs, and cryptocurrencies with an easy-to-use portfolio tracker.

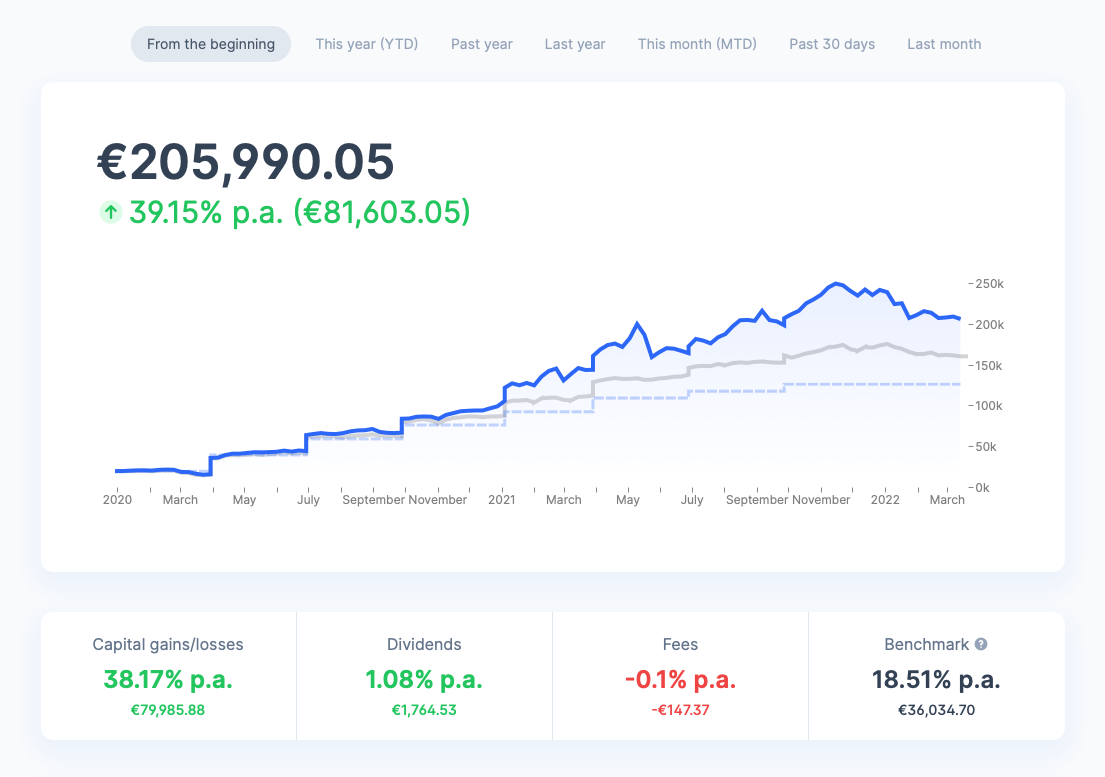

Most brokers don't show you the numbers that matter in the long term. We show you your true net annualized return rate, annualized fee ratio, capital gains yield, and dividend yield.

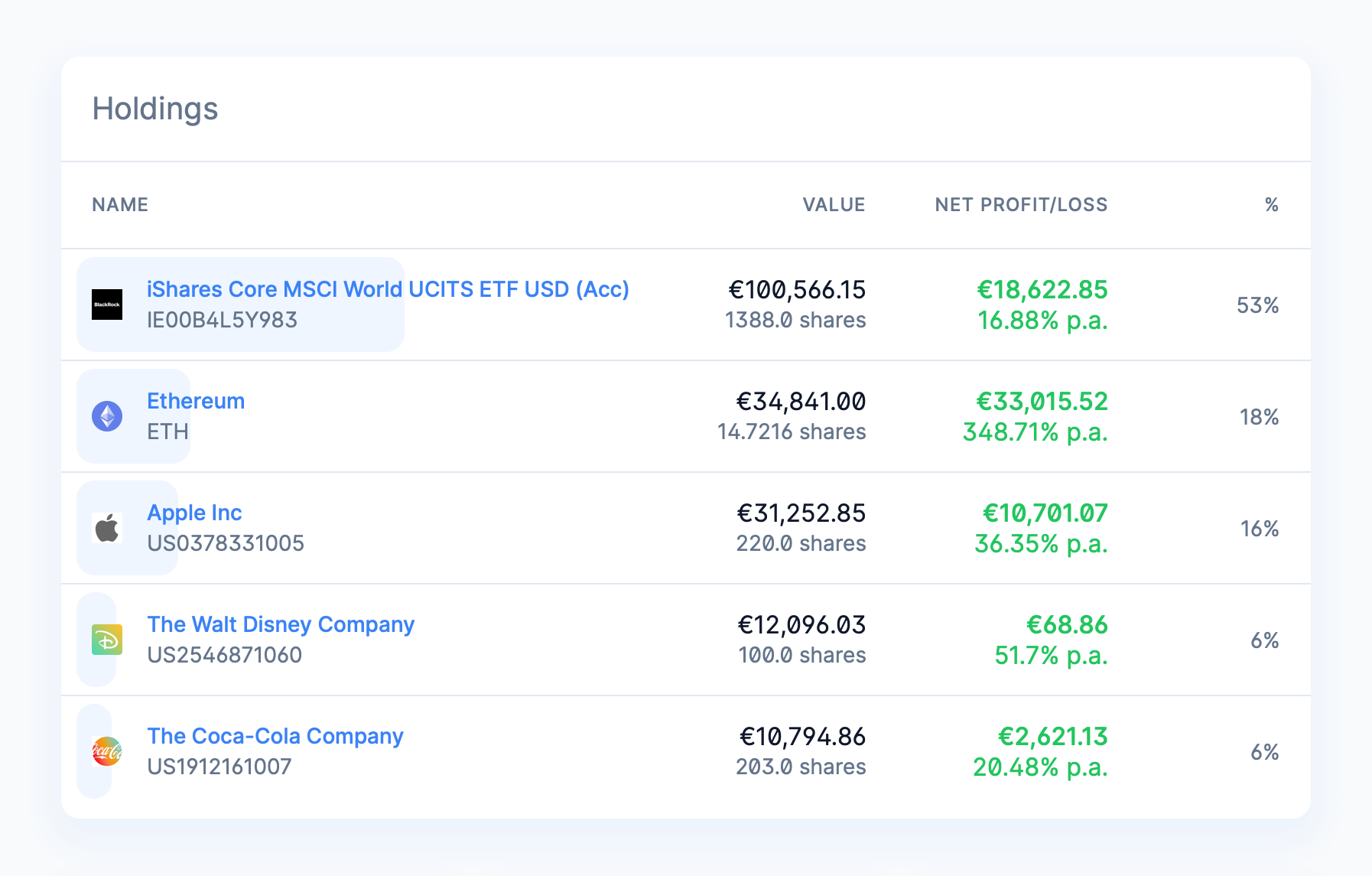

Get a perfect overview of all your investments in one place. Easily see your asset allocation and how well each asset performs. For each holding, we show you its absolute and annualized net return including fees and dividends.

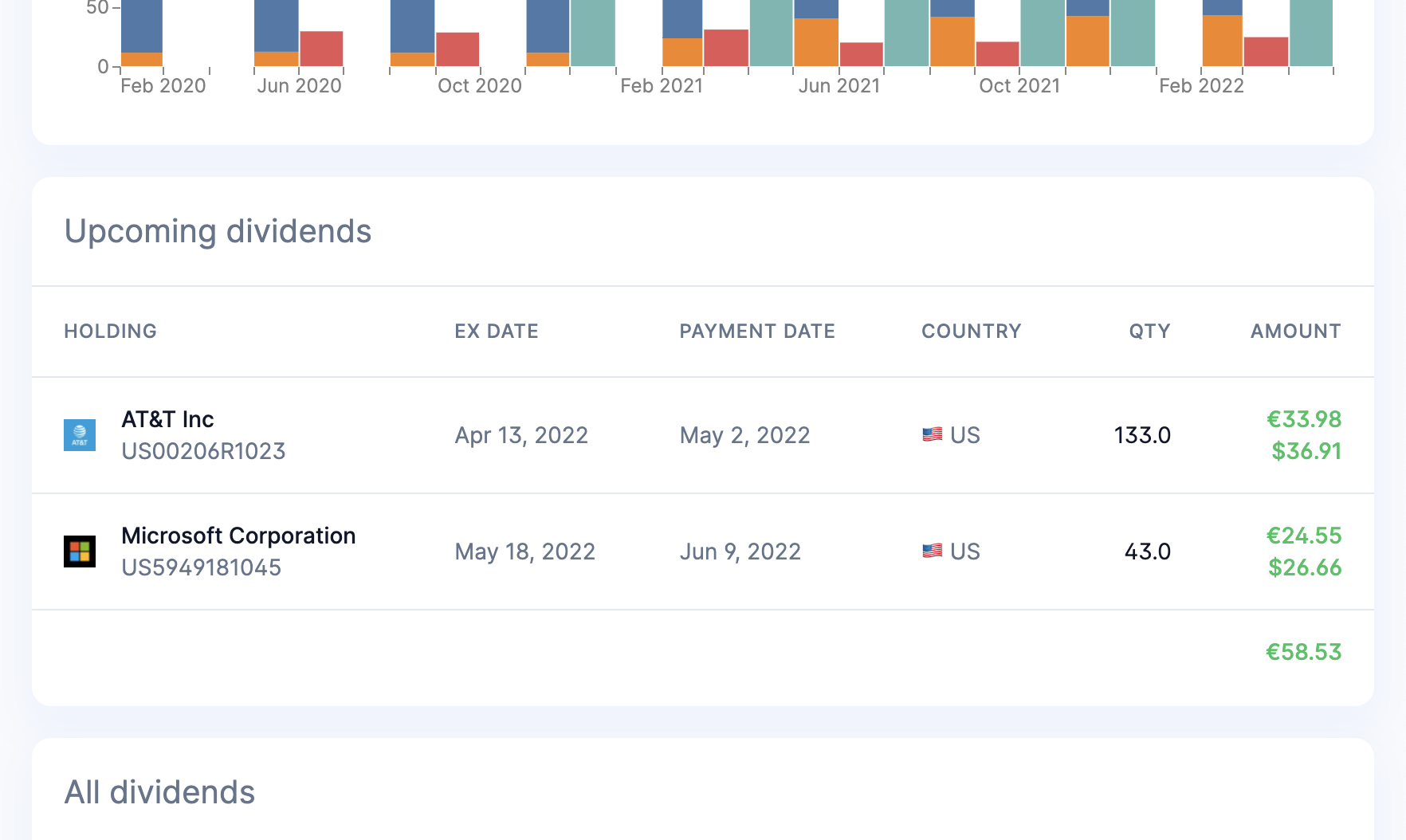

You no longer have to manually enter your dividends into a spreadsheet. All dividends and other corporate actions get automatically imported into your portfolio.

Track your upcoming dividends so that you can plan which holdings to keep and which to sell.

Make sure your portfolio is well diversified by breaking it down by asset class, region and sector

See how would your portfolio perform if you invested the same amounts in a benchmark of your choice such as S&P 500.

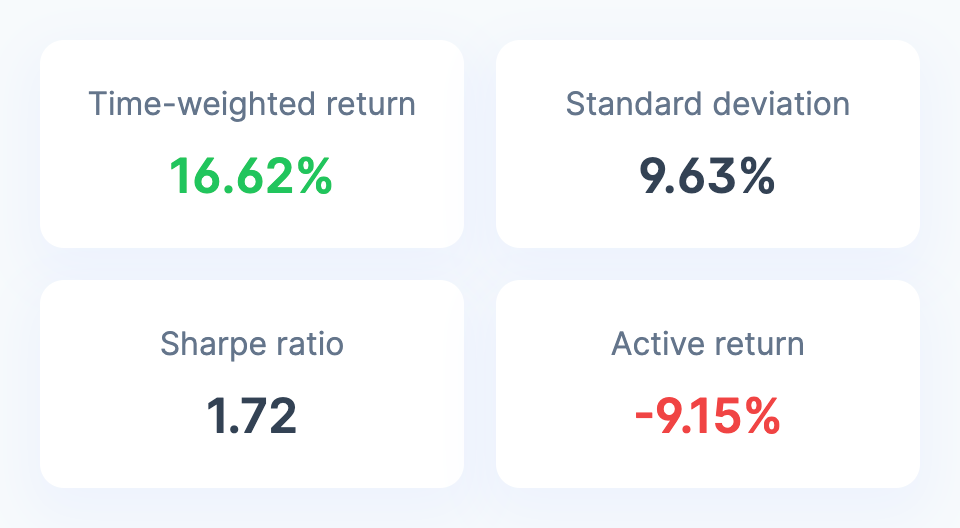

Track your portfolio risk, see your risk-adjusted return and compare it to a benchmark.

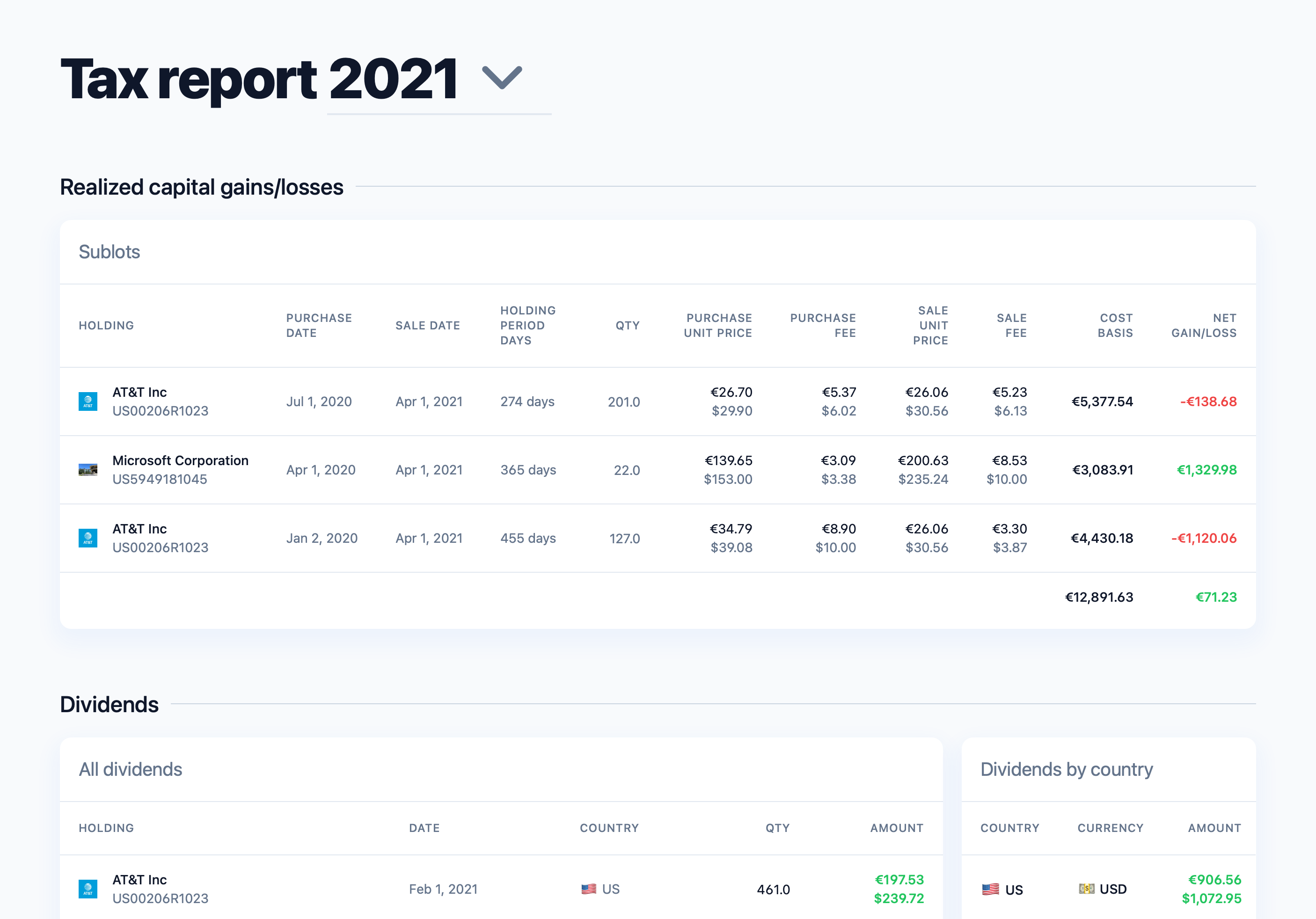

Doing your taxes used to be a hassle. Not anymore. With our detailed tax report, you have everything you need to file your taxes. See a sample tax report.

You don't have to enter your trades manually. Just drag & drop your account statements from your broker or spreadsheets. We do the rest.

Don't take our word for it. See what our customers have to say.

Works very well!!

Nice UI analytics interface on top of the limited performance data that my broker provides.

Simple Portfolio is the tool I needed - I've had a DeGiro account for about 7 years, but didn't have a way of tracking assorted metrics over time. But this tool has really allowed me to get a handle on my investments and their performance, and helps me feel more informed.

Jakub, the creator, is also really responsive to emails. I had a query for him, and not only did he respond, but implemented an update to the app that displayed what I wanted to see.

Highly recommended.

TBH I'm surprised by how fast it is. I used to use a different desktop app before and it took ages to calculate the values for different time frames. And the UX... I love it

A way to actually see my percentage gains in DEGIRO. LOL.

smooth app by the way 🙂

Simple tool to easily see my current portfolio and per annum returns.

useful, easy to use and convenient

Looks really clean!

Every functionality you're missing in DEGIRO in terms of visualisations and overviews is in Simple Portfolio.

It helps me see the bigger picture across my whole portfolio.

€ 0 /month

or € 0/year

Recommended

€ 8 /month

or € 80/year 2 months for free

Ask us at [email protected] or via the chat.